ePay Punjab

ePay Punjab

The official app & game

Distributed by UptoPlay

SCREENSHOTS

DESCRIPTION

Use UptoPlay to play online the game ePay Punjab.

What is e-Pay Punjab?

ePay Punjab is the first ever digital aggregator for Public to Government (P2G) and Business to Government (B2G) payments in Pakistan.

Using ePay Punjab, dues can be paid through the following four payment channels.

Mobile Banking

Internet Banking

ATM

OTC (Over the Counter) banking transaction

The solution is developed by The Punjab IT Board (PITB) under the instructions and guidance of The Finance Department of Punjab. At the backend it is integrated with State Bank of Pakistan (SBP) and 1-link for interconnectivity across the entire banking network in Pakistan.

Payment Process and Channels

To pay the tax dues, an individual will access e-Pay Punjab application or website to generate a 17-digit PSID number. The PSID number that is unique for each transaction could subsequently be used on the aforementioned four payment channels i.e. Mobile Banking, Internet Banking, ATM or OTC by the citizens to pay the tax dues.

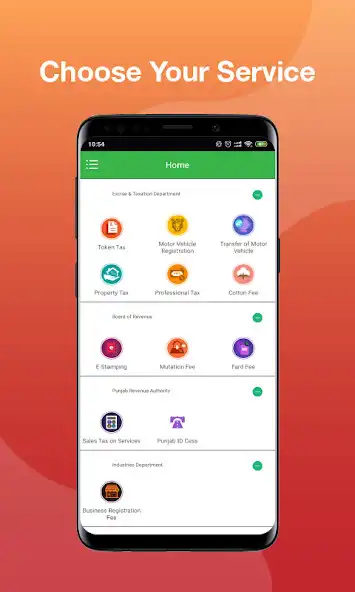

Currently, following tax receipts can be paid via e-Pay Punjab:

Excise & Taxation

Token Tax for Vehicle

Motor Vehicle Registration

Vehicle Transfer

Property Tax

Professional Tax

Cotton fee

Board of Revenue (BOR)

e Stamping

Mutation fee

Fard fee

Punjab Revenue Authority (PRA)

Sales Tax on Services

Punjab Infrastructural Development Cess

Industries

Business Registration fee

Transport Department of Punjab

Route Permit

Punjab Police

Traffic Challan

Tax Descriptions

Token Tax for Vehicle: Annual tax paid by owners of motor vehicles.

Motor Vehicle Registration: One-time fee paid by the buyer of new

vehicle at the time of purchase.

Vehicle Transfer: Fee paid at the time of transfer of vehicle to a new owner.

Property Tax: Annual tax paid by property owners in urban areas.

Professional Tax: Taxes paid by the working professional on his profession on an annual basis.

Cotton Fee: Fee paid on raw cotton brought to ginning factory.

e-Stamping: Payment of stamp duties on judicial, non-judicial, CVT, registration and comparison fee.

Mutation Fee: Fee paid by the buyer at the time of transfer of property to a new owner.

Fard Fee: Fee paid by the owner of property for the issuance of property ownership document.

Sales Tax on Services: Taxes levied on service oriented business in the province of Punjab

Punjab Infrastructural Development Cess: Levy collected on transportation of goods manufactured, produced or consumed in, imported into or exported out of the Punjab.

Business Registration Fee: Fee paid by the owner to register his business.

Route Permit: Fees paid by owners of commercial vehicles for allotment / permission of specific routes for inter / intra city travel

Traffic Challan: Traffic Challan is the fine paid for violating traffic rules.

Enjoy with UptoPlay the online game ePay Punjab.

ADDITIONAL INFORMATION

Developer: Punjab IT Board

Recent changes: We constantly update the app to make it better for you. This version includes bug fixes and performance improvements.

Thank you for using ePay Punjab

Page navigation: