Indifi Unsecured Business Loan

Indifi Unsecured Business Loan

The official app & game

Distributed by UptoPlay

SCREENSHOTS

DESCRIPTION

Use UptoPlay to play online the game Indifi Unsecured Business Loan.

Business Loan, Working Capital Loan, MSME Loans, No Collateral, Unsecured Business loans

Indifi is leading online lending platform which has its own credit rated, and RBI-registered NBFC, along with other lenders offering unsecured business loans to MSMEs

We have disbursed 41000+ MSME loans & business loans across 400+ cities to meet their working capital requirements. Loans range from Rs. 1 to 50 lacs to various industries like retail, restaurant, and more.

Why take Indifi Unsecured Business Loan?

Apply from anywhere 100% business loan online process

Easy process - dedicated relationship manager for help

Minimal documents

Attractive lending rates starting @ 1.5% pm

Flexible business loan tenure From 12 to 36 months

Fast disbursals in just a few days

Flexible repayment terms

Customized loans For retailers, traders, restaurants, online sellers & more

No hidden charges

One Application, multiple offers: Get offers from many lenders like: NorthernArc | IIFL | Riviera, our own NBFC, and more

Indifi offers many lending products as per the needs of small businesses.

What do we offer for MSMEs?

Term Loan for MSMEs: One of the most common ways for any MSME to get quick loans is a term loan. Get a fixed amount for a fixed tenure at low interests.

Merchant Advance (Loan against POS machines): Suitable for businesses that process a lot of card swipes. Retailers, online sellers, and traders may use this.

Invoice Discounting: Small businesses or entrepreneurs can use their unpaid invoices to generate revenue for operating expenditures.

Line of credit: Suitable for regular cash flow. Businesses require money to get cash discounts, offer credit to clients, pay vendors, and meet seasonal needs.

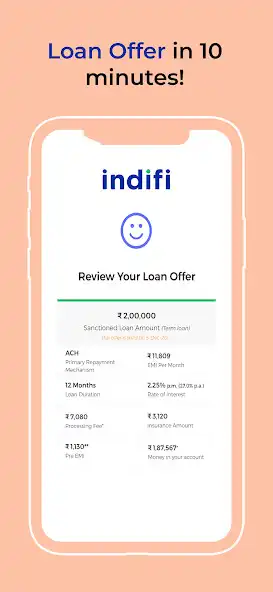

An Example of a Term loan with Indifi:

Loan Sanction Amount: 10,00,000/-

Disbursement Amount: 9,76,400/-

Processing Fees (Including GST @18%): 23,600

Interest Rate: 1.5% per month

Instalment Amount: 49,924

Repayment Tenure/Frequency: 24 / Monthly

A loan can be called differently by different businesses. At Indifi, all business-related funds can be availed.

1. Business Loans

2. MSME Loans

3. Working Capital Loans

Who is eligible for a business loan?

1. Businesses with >12 months operations

2. Promoter age > 22 years old

3. Businesses with turnover > INR 5 lakhs

4. Business with GST registration

We offer flexible online loans through business loan app to some industries:

Loans for E-commerce sellers: Fulfil business needs like stocking inventory or creating a new product range with unsecured loans for e-commerce industry

Loans for Restaurants & Delivery Outlets: Setting up a new outlet, investing in the base kitchen or building working capital, Indifi business loan has it all covered

Loans for Retailers: Weve curated loans for special needs like stocking inventory, meeting seasonal demand or offering credit to customers

Loans for Pharma Businesses: Our unsecured loan helps manage payments, credit from suppliers, and other needs

Loans for Traders: We extend quick loans to managing credit & working capital cycles, procuring inventory & selling further

We have also partnered with many businesses from diff industries to extend business loans. Some of them are

1. Swiggy

2. Zomato

3. Amazon

4. FirstData

5. Eko.in

Additional App Features:

One view to see all loan details and play online statement

Simple payment gateway for loan repayment

Auto Loan top-up offers & request for additional loan

Raise support tickets for loan-related queries

For more information, visit www.indifi.com. You can also call us at 011-408-44715 & speak to our loan expert (Mon to Sat excluding public holidays & 4th Sat of every month). Or write to us at [email protected]

Enjoy with UptoPlay the online game Indifi Unsecured Business Loan.

ADDITIONAL INFORMATION

Developer: Indifi Technologies

Page navigation: